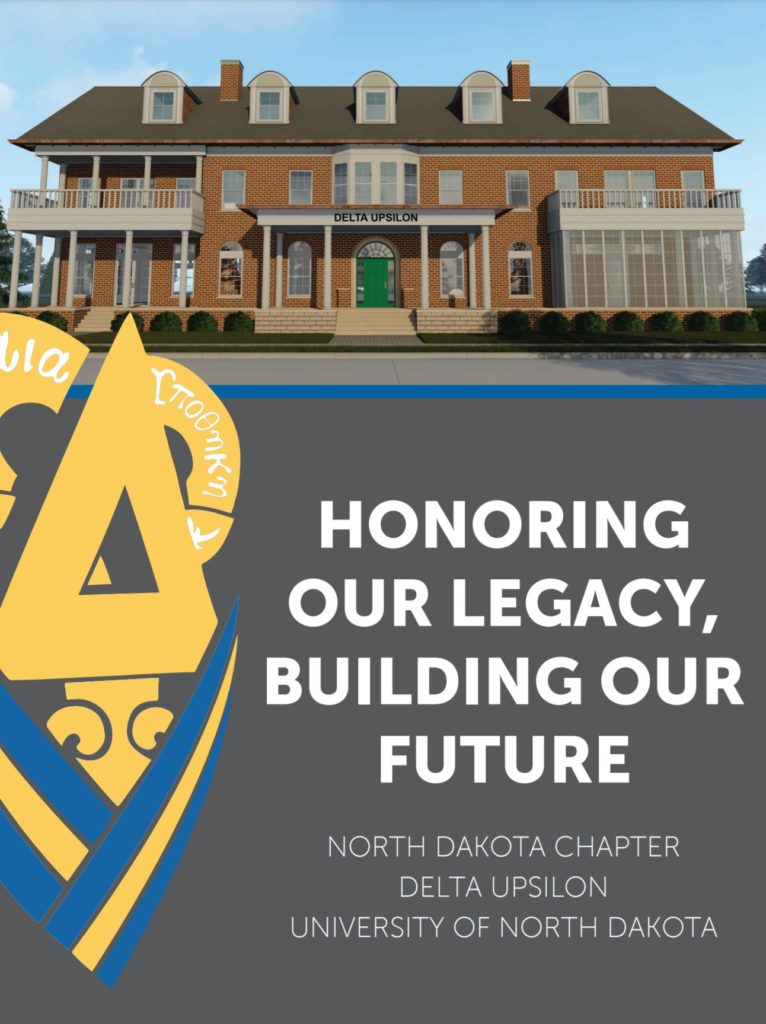

As a DU Alumnus, you are the only one who can place a value on your DU experience—on the lifelong friendships you made, on the development of your values and principles, and on the many ways our fraternity has enhanced your career and life.

Remember that each of us benefited from the generosity, work, and sacrifice of those who went before us. We all enjoyed the comfort and brotherhood Delta Upsilon provided during our years in Grand Forks and after we left campus. Now it is our turn to repay the fraternity by building a home for the next 100 years.

We urge your thoughtful consideration of this plan. With your support, Delta Upsilon will provide a superb living environment that supports, nurtures, and develops outstanding young men with the skills and confidence to face an ever-changing world. The commitment we make today cannot be underestimated. It will have a far-reaching effect on the lives of our DU brothers for generations to come.

TAX DEDUCTIBILITY

We have worked to maximize the portion of this project qualifying as educational space for the IRS. However, significant parts of the project do not qualify as educational, thus those expenses are not tax deductible. To complete the project as envisioned, donors who pledge $25,000 or greater may be eligible for a portion of their gift to be tax deductible through the North Dakota Delta Upsilon Education Foundation.

GIFT OF SECURITIES

A contribution of appreciated securities to a 501(c)(3) will not ordinarily be subject to capital gains tax on the appreciated value of the gift. If you are 70 ½ or older, an IRA charitable rollover gift can satisfy all or part of the required minimum distribution.

Please consult your tax advisor for potentially significant tax advantages. To make a gift of securities, please contact brother Rod Kirsch at (814) 777-4826.

MATCHING GIFT

If your employer offers a matching gift program, you may be able to double your contribution to the Foundation.

Please include a matching gift form with your campaign pledge form.

RECOGNITION

Donors of $2,500 and above will be recognized in the appropriate giving categories in all campaign publications, unless otherwise requested by the donor. Donors at $5,000 and above will be recognized on a permanent plaque. Naming opportunities exist for individual donors of $25,000 or a cumulative gift of $50,000. Please consult your financial advisor, accountant, or attorney for professional tax advice.

Please contact brother Rod Kirsch, our campaign coordinator, at (814) 777-4826 RodKirsch99@gmail.com for more information.

Giving Levels

Dikaia Upotheke Society

$500,000 and greater

1834 Founders Society

$250,000 to $499,999

1961 Founders Society

$150,000 to $249,999

Justice Society

$100,000 to $149,999

Character Society

$50,000 to $99,999

Liberal Culture Society

$25,000 to $49,999

Friendship Society

$10,000 to $24,999

Oxford Society

$5,000 to $9,999

Blue & Gold Society

$2,500 to $4,999